AU Form 919 2018-2024 free printable template

Show details

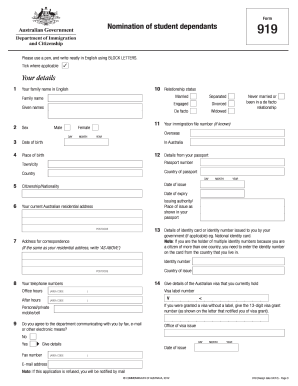

Your dependant s should complete form 157A Application for a student visa online and attach this form 919 Nomination of student dependants. Form Nomination of student dependants Department of Home Affairs About this form Integrity of nomination Important Please read this information carefully before you complete this nomination* Once you have completed this nomination we strongly advise that you keep a copy for your records. This form is to be used by Student Temporary Class TU visa holders...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 919 form 2018-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 919 form 2018-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 919 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 919. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

AU Form 919 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 919 form 2018-2024

How to fill out 919 form 2022:

01

Start by carefully reading the instructions provided with the form. This will give you an overview of the information you need to provide and any specific guidelines to follow.

02

Gather all the necessary information and documents required to complete the form accurately. This may include personal identification details, financial records, employment information, and any other relevant documents.

03

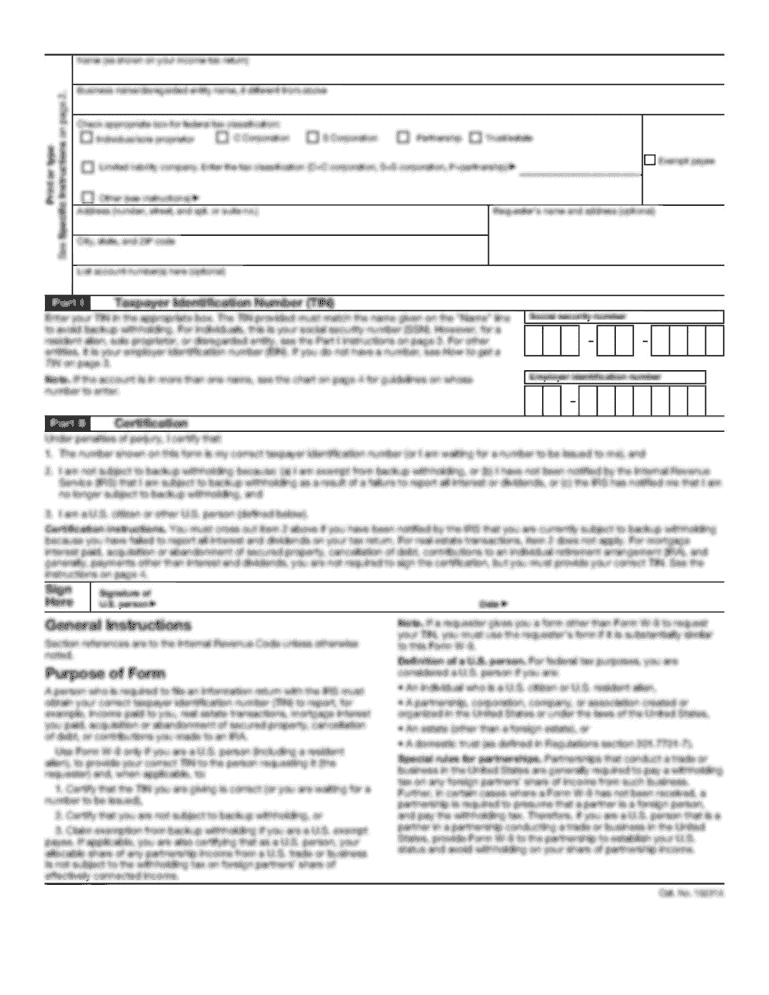

Begin by entering your personal details in the designated sections of the form. This typically includes your name, address, social security number, and contact information.

04

Follow the form's instructions to provide information regarding your income, assets, and liabilities. Ensure that you provide accurate and up-to-date information, as any discrepancies may result in delays or complications.

05

If the form requires you to provide additional schedules or attachments, make sure to complete them accurately and attach them appropriately.

06

Review the completed form thoroughly to check for any errors or omissions. It's essential to ensure that all the information provided is correct and complete.

07

Sign the form using the designated signature section. If you're filing jointly with a spouse or partner, they may also need to sign the form.

08

Make copies of the completed form and any accompanying documents for your records.

09

Finally, submit the filled-out form to the relevant authority by the specified due date, following their instructions for submission.

Who needs 919 form 2022:

01

Individuals who are required to report their income, expenses, and financial details to the appropriate authorities.

02

Specifically, the 919 form 2022 may be needed by individuals who fall under certain tax obligations or who are subject to specific reporting requirements.

03

The exact eligibility criteria for the 919 form 2022 may vary based on the jurisdiction or regulatory body that governs the particular form's usage.

04

It's advisable to consult with a tax or legal professional or refer to the official guidelines and regulations to determine if you need to fill out the 919 form 2022.

Video instructions and help with filling out and completing 919 form

Instructions and Help about form 919 nomination of student dependants

Fill autralia form nomination : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 919 form?

The 919 form is a document that must be completed and submitted to the Internal Revenue Service (IRS) by employers who are required to provide a tax return for their employees who are nonresident aliens. The form is used to report income that was earned by nonresident aliens and taxes that were withheld from that income.

Who is required to file 919 form?

The 919 form is a tax form for self-employed individuals and independent contractors who have received income from sources other than their employers. It is used to report income and calculate taxes.

How to fill out 919 form?

1. Start by writing the date of the form in the top right corner.

2. Provide your name, address, and phone number.

3. Enter the name of the employer or other entity for whom you are filing the 919 form.

4. Indicate the type of form you are filing.

5. Specify your employment status - whether you are an employee, independent contractor, or other.

6. Enter your Social Security number.

7. Provide your total taxable wages, salary, or other compensation for the year.

8. Report the total amount of taxes withheld.

9. Enter any additional information requested such as deductions, credits, or estimated tax payments.

10. Sign and date the form.

What is the purpose of 919 form?

The 919 form is an application for an Employer Identification Number (EIN). It is used by businesses to identify themselves for tax purposes.

When is the deadline to file 919 form in 2023?

The due date for filing Form 919 for the 2023 tax year is April 15, 2024.

What is the penalty for the late filing of 919 form?

The penalty for the late filing of Form 919 is up to $25 per day, up to a maximum of $10,000.

What information must be reported on 919 form?

Form 919 is used to report the Income Tax Return for Commercial Activities. The information that must be reported on this form may vary depending on the specific requirements of the tax authority in the relevant jurisdiction. Generally, the information required on Form 919 includes:

1. Business details: This includes the name, taxpayer identification number, legal form, and address of the business entity.

2. Income details: The form typically requires reporting of various types of income, such as sales revenue, service fees, rental income, interest income, dividends, and any other income generated from commercial activities.

3. Deductions: It is common to report deductible expenses related to the commercial activities, including salaries and wages, rent expenses, utilities, office supplies, advertising costs, legal and professional fees, and other necessary expenses incurred for running the business.

4. Financial statements: The form often requires the submission of financial statements, including balance sheets, profit and loss statements, and cash flow statements to provide a comprehensive overview of the financial position and performance of the business.

5. Tax credits, exemptions, and incentives: If there are any tax credits, exemptions, or incentives applicable to the business, these may also need to be reported on the form.

6. Supporting documentation: It is common for the tax authority to request supporting documents, such as invoices, receipts, bank statements, and other relevant documents to verify the accuracy of the reported information on Form 919.

It is important to note that the specific details and requirements for Form 919 can vary depending on the country or jurisdiction. Therefore, it is advisable to consult the tax authority or a qualified tax professional for accurate and up-to-date information relevant to your specific circumstances.

How can I manage my 919 form directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your form 919 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify au form nomination without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your dependent student visa australia into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I edit form 919 pdf on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit form 919 nomination of student dependents.

Fill out your 919 form 2018-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Au Form Nomination is not the form you're looking for?Search for another form here.

Keywords relevant to 919 form for australia

Related to form 919 australia

If you believe that this page should be taken down, please follow our DMCA take down process

here

.